Health Insurance Solutions for Individuals & Families

Explore private, Medicare, and health-sharing plans designed to meet your health needs and budget.

Finding the Right Health Insurance Can Be a Maze

Navigating health insurance options can be overwhelming. Whether you need private insurance, are exploring Medicare, or are considering a health-sharing plan, the process can feel confusing and complex. Without the right plan, you could face high medical costs, limited coverage options, or lack of access to preferred healthcare providers.

Personalized Health Insurance Solutions That Fit Your Needs

At ICT Insurance, we simplify the process of finding the right health insurance plan, working with you to understand your needs and financial situation. Our expert brokers offer guidance on private plans, Medicare options, and health-sharing programs, helping you find affordable and comprehensive coverage. We provide tailored advice to help you make the best choice for you or your family, offering peace of mind and clarity in a complex market.

Explore Our Health Insurance Options

Private Health Insurance

Offering access to both on- and off-exchange plans, ICT brokers can help you find comprehensive private health insurance. Ideal for individuals, families, small business owners, or those who lose group coverage and face high COBRA premiums. Options range from basic coverage to more comprehensive plans with a wide range of benefits.

Health Sharing Plans

Health-sharing plans operate similarly to traditional insurance but have different rules for pre-existing conditions and costs. With partners like Medishare, Oneshare Health, and Christian Health Ministries, ICT Insurance can guide you through health-sharing as a flexible, affordable alternative to traditional insurance.

Supplemental Health Insurance

Supplement your primary coverage with specialized plans for hospitalization, surgery, ER visits, accident coverage, and more. Many of these plans provide direct benefits without a deductible, offering ‘first-dollar coverage’ to reduce your out-of-pocket expenses.

Affordable Healthcare Plans & ACA

ACA plans, often known as Obamacare, have evolved to offer more competitive coverage options across most states. With bronze plans available at low or $0 premiums, ICT Insurance brokers help you navigate options that fit your needs and budget while taking advantage of available subsidies.

Trusted Partners in Health, Life, & Medicare Coverage

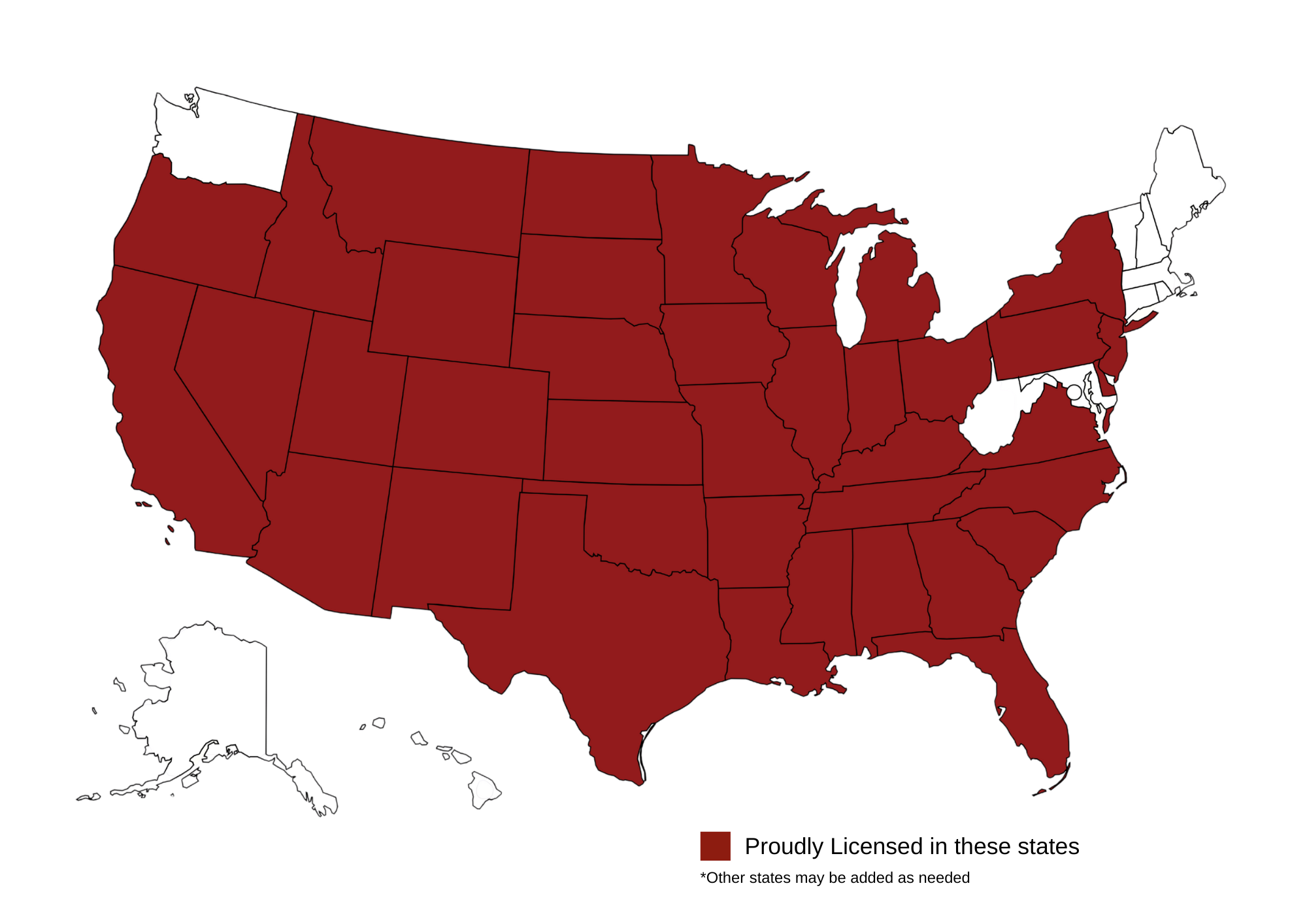

ICT Insurance is Proud to Offer Health, Life, & Medicare Solutions Nationwide

Countdown to Coverage: Open Enrollment Period

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)

Get Started on Your Health Insurance Journey

Let ICT Insurance guide you through finding the best coverage for you and your family.

Health Insurance FAQs

Why do I need health insurance?

A key reason why health insurance is important is because you cannot predict your future health care costs. In some years, your medical expenses may be low. In other years, you may have a serious illness or accident that can be very expensive. Most health plans have deductibles and out-of-pocket limits that help protect your finances from these unpredictable expenses.

What is a deductible?

A deductible is the amount you need to pay for medical services yourself, before insurance begins paying its share of the cost. For example, if your health plan has a $1,000 deductible and you go to the doctor, you’ll pay $50 out of pocket — but once you’ve paid $1,000 in covered expenses during a service period (usually each calendar year), your insurance will start paying 100 percent of your health care costs.

What is a premium?

A lot of people don’t understand what a premium is. A premium is the fee you pay every month to have health insurance. It’s the fee that covers the cost of co-pays at the doctors, emergency transportation to hospitals, or prescription medication if you are on any kind of drug treatment. Your premium is what helps your health insurance company cover their costs, and stay in business. That means they don’t have to raise your rates year after year because they aren’t losing money every month.

What is a health savings account?

HSAs are like any other savings account, except the money in them is reserved for medical expenses. This type of health care plan allows you to save for the future while using the money you save to pay for current health care expenses. Plus, whatever you don’t use by December 31 can be rolled over into the next year.

Is health insurance tax deductible?

If you are self-employed, your health insurance premiums can be deducted on your return. If you, or your spouse, are covered under another plan, the premiums cannot be deducted. You may deduct any contributions you make to a qualified health savings account (HSA).

When is open enrollment for health insurance?

The open enrollment period for ACA Marketplace health insurance for the 2025 coverage year runs from November 1, 2024, to January 15, 2025. To have coverage start on January 1, 2025, you must enroll by December 15, 2024. However, it’s important to note that open enrollment dates may vary by state. Some states with their own health insurance exchanges may extend their enrollment periods beyond January 15. We recommend contacting an agent for more information specific to your state to ensure you have the most accurate and up-to-date details regarding open enrollment deadlines.