Secure Your Retirement with the Right Annuity Plan

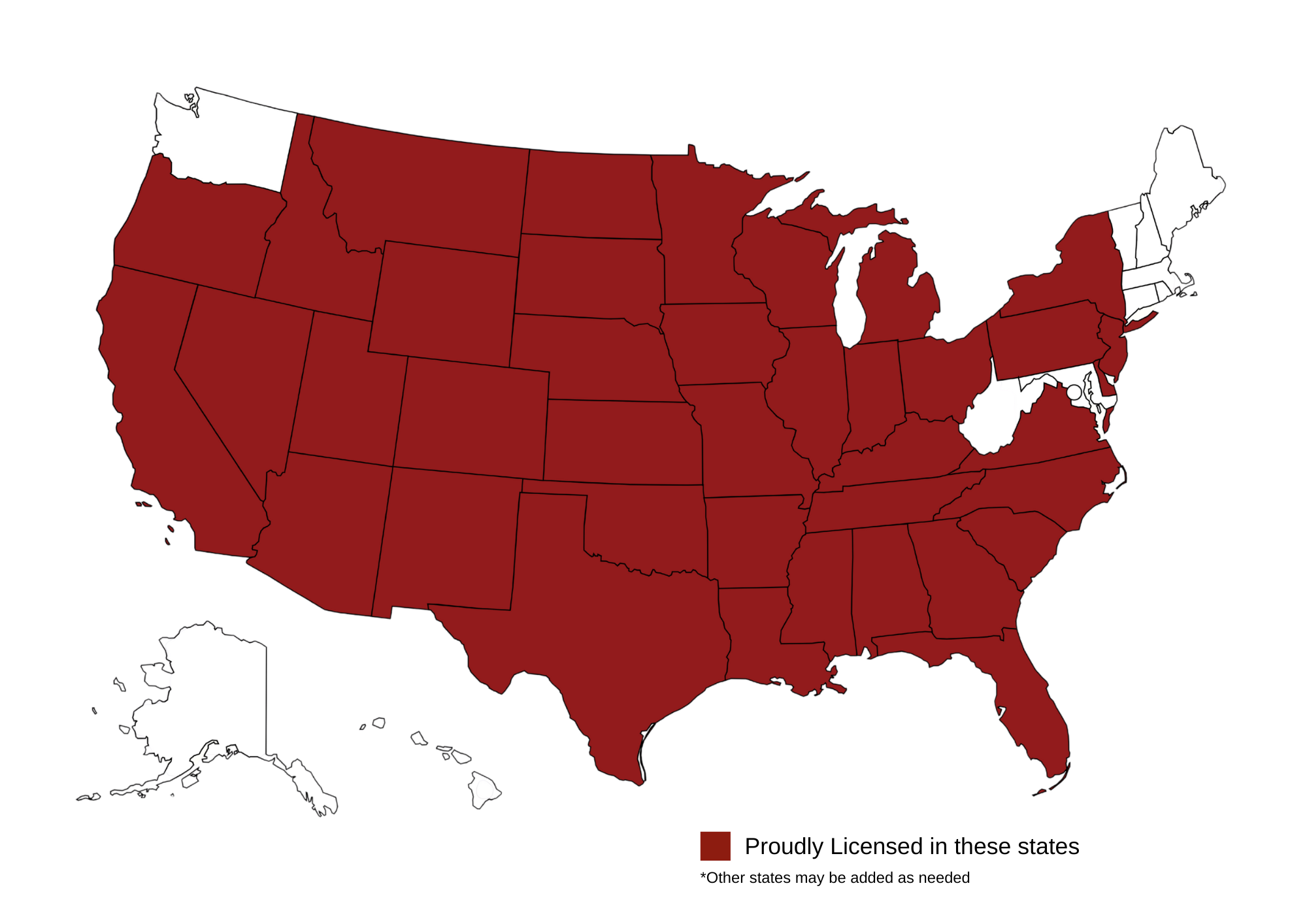

At ICT Insurance Group, we understand that planning for retirement can feel overwhelming. That’s why we help individuals and families across Kansas and 28 other states find annuity solutions tailored to their goals.

What is an Annuity?

An annuity is an insurance contract designed to provide income in the form of regular payments while also offering the potential for growth. Annuities are most commonly thought of as a way to create a steady and reliable income stream for retirement.

Annuities provide insurance against the risk of outliving your money after you stop working. You get the potential to grow your savings and create guaranteed income for life.

Annuities may seem to function as an investment (that is, you put your money in and accept the risk of whether it increases or decreases). However, they’re actually insurance contracts with predetermined parameters. In general, if you follow the rules of the annuity contract, you receive certain guarantees in return.

Why Choose an Annuity?

Planning for the future means making smart decisions today. An annuity can:

- Guarantee income for life

- Help you beat traditional safe asset classes such as CD’s, Bonds, and Money Market accounts

- Protection against market losses

- Provide financial protection against long-term care expenses

- No medical qualification necessary like you would with other insurance products

Our team takes the time to match you with the right annuity solution based on your needs and future plans.

Explore Our Annuity Options

Single Premium Immediate Annuities (SPIAs)

An immediate annuity helps make retirement planning easier because it’s predictable. In exchange for a lump sum of money, an immediate annuity pays a guaranteed amount for a specified time period, including as long as you or your spouse live.

Fixed Annuities

A fixed annuity provides you with tax-deferred growth at a fixed rate of interest set by the annuity provider for a period of time specified in the annuity contract. It also offers the opportunity to produce a guaranteed stream of retirement income you cannot outlive.

Fixed Indexed Annuities (FIAs)

With a fixed indexed annuity, the interest on a portion of your premium is tied, in part, to a published stock market index, giving you the opportunity to benefit from market trends without owning stocks. Your principal is protected from loss due to market downturns. A fixed indexed annuity may also include or offer optional riders that can be purchased or automatically attached to the annuity for a charge. Rider features vary by product, and can offer benefits like lifetime income, increased liquidity, or a death benefit option.

Trusted Partners in Health, Life, & Medicare Coverage

ICT Insurance is Proud to Offer Health, Life, & Medicare Solutions Nationwide

Countdown to Coverage: Open Enrollment Period

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)

Get Personalized Annuity Advice Today

Let ICT Insurance guide you through finding the best coverage for you and your family.